Asia's growing economies are a big deal for Saudi Arabia, which is trying to wean itself off a dependence on oil.

"As Saudi looks to the future, Asia of course is front and center," said Ben Simpfendorfer, CEO of Silk Road Associates. "It is two thirds of the world's population, half of its economy -- and those shares will only grow."

The kingdom is the world's largest oil exporter, so it's little surprise that energy is top billing as Salman travels with 1,500 people in tow. He's already been to Malaysia and Indonesia, with economic giants Japan and China up next.

Related: Here's how the Saudi king travels

Going where the growth is

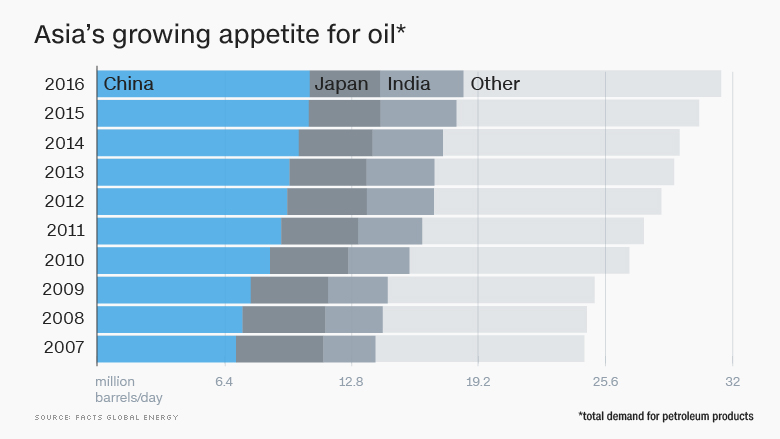

The big focus for major oil producers is on markets where demand is growing. Right now, that means Asia.

Growth in global demand for crude is forecast to accelerate to 1.4 million barrels a day this year, according to FACTS Global Energy. One million of that is expected to come from Asia.

Other oil producing heavyweights haven't overlooked that fact. Saudi Arabia is vying with other Arab states as well as Iran and Russia for a bigger slice of the Asian market.

Related: Saudi economy will barely grow this year, IMF says

Preparing for a mega IPO

It's not just the region's fast growing emerging markets that are important. Japan's mature economy has overtaken China as Saudi Arabia's largest oil customer, according to Fereidun Fesharaki, chairman of FACTS Global Energy.

"This is why the king is going to Japan," he said. "It is very important for them that they keep the Japanese market warm."

Japan holds other interests, too. Saudi Arabia's sovereign wealth fund is teaming up with Japanese firm SoftBank (SFTBF) to launch a massive $100 billion tech investment fund.

The kingdom may also want to court Japanese investors as it prepares to sell shares in state oil giant Aramco next year in what's expected to be the world's biggest ever IPO.

In Malaysia and Indonesia, Saudi Arabia signed refining deals worth $13 billion -- major investments in fast-growing markets that could help bolster Aramco's IPO plans, and secure new outlets for its crude oil.

Related: Trump is banking on a big tech investment (from the Middle East)

Looking beyond oil

After Tokyo comes Beijing, where Aramco has its Asian headquarters. Saudi Arabia and China already have refineries in each other's territory.

But there is plenty to consider beyond energy. Saudi Arabia is eager for China to help its drive to diversify and break free of its oil addiction, a top priority of King Salman's young but powerful son, Deputy Crown Prince Mohammad bin Salman.

His big plan, "Saudi Vision 2030," aims to boost the role of the private sector and make the kingdom a competitive hub for manufacturing and services. The need for change has been highlighted by the pain inflicted on the Saudi economy by the drop in oil prices in recent years.

"When you have to start thinking of your non-oil future... then all of a sudden geography matters," Simpfendorfer said.

Saudi Arabia's renewed interest in Asia dovetails nicely with Chinese President Xi Jinping's "One Belt, One Road" plan. The initiative is aimed at connecting China with over 60 countries -- from Asia to the Middle East and Europe -- through the rebuilding of roads, railways and ports to speed up trade.

Related: Chinese President Xi Jinping defends globalization

'The Chinese provide the options'

China's ruling Communist Party has a history of delivering on long-term strategic projects. That's an approach the Saudis would like to emulate after failing to think beyond oil for a long time.

"You have somebody in China who has technology, money, people and the market, and somebody in Saudi Arabia who wants to look at future options," Fesharaki said. "The Chinese provide the options."

Those options, strategists say, take on added importance after the inauguration of President Trump, whose policy towards the complex and volatile Middle East remains unclear.

"Saudi [Arabia] rediscovered Asia over the last 10 years, yet momentum was fading," Simpfendorfer said. Now, rising political uncertainty elsewhere has reinvigorated that push.

CNNMoney (Beijing)

Add Category

Add Category